Are you being bullied by debt collectors? Don't let them push you around. You have lawful options. Our group of experienced legal professionals can assist you in cessing the harassment and protecting your well-being.

We offer free consultations to discuss your case. Call us today to learn more about how we can fight you.

- We specialize in debt collection representation

- Skilled legal team

- Confidentiality guaranteed

Don't procrastinate. Take control of your situation. Let us assist you regain peace of mind.

Swamped in Debt? Find Relief with Debt Consolidation Loans

Are you feeling the weight of multiple debts? A combination loan can deliver a streamlined way to tackle your debt. By merging several payments into one {monthly{ payment, you can potentially lower your interest rates. This can unburden money in your financial plan and aid you obtain your monetary goals.

Conquer Payments: Get Started with Debt Settlement Today

Are you overwhelmed by crushing debt? Do monthly payments feel impossible to cope with? It's time to take control and explore the benefits of debt settlement. This powerful strategy can help you decrease your overall debt burden and get financially stable. Our expert negotiators will represent creditors to obtain a lower payoff amount, giving you a fresh start and financial freedom.

Break Free from Debt: Proven Strategies for Financial Success

Are you overwhelmed by accumulated debt? Do you dream for a financially stable future? You're not alone. Millions of people struggle with debt, but it doesn't have to control your life. The challenges you face and we're dedicated to helping you attain financial freedom through our customized debt resolution strategies.

Our team of dedicated professionals will work with you one-on-one to develop a personalized plan that fulfills your specific needs. We offer a range of debt resolution programs including debt consolidation, credit counseling, and settlement.

- We can assist with lower monthly payments with your creditors.

- You'll achieve a better understanding of your budgeting needs.

- Start your journey towards financial freedom today.

Reach out now for a complimentary consultation and let us assist you regain control of your finances.

Financial Advocates

Are you overwhelmed debt? Feeling stuck in a system that seems designed to hold you back? You're not alone. Many people find themselves battling mounting obligations. The good news is, there are resources available to help you fight back and reclaim your security.

Debt advocates possess the knowledge in navigating the complex world of debt collection. They can examine your accounts for errors, negotiate with creditors on your behalf, and explore options to minimize your financial responsibility.

- Consider seeking help from a reputable debt dispute specialist if you feel overmatched by the debt collection process.

- They can provide valuable understanding into your rights and options, possibly leading to significant financial savings.

- Keep in mind you don't have to face this situation alone. There are people who are committed to help you reach a more manageable financial future.

Eliminate Debt Stress: Get Personalized Solutions from Professionals

Feeling overwhelmed by debt? You're not alone. Many people struggle with financial stress, and it can weigh heavily your overall well-being. The good news is that you don't have to face this challenge alone. Consulting professional help can empower you to formulate a personalized plan to tackle your debt Relief for Menopause Symptoms and regain control of your finances.

Experts in the field, such as certified financial advisors or credit counselors, can evaluate your current situation, identify areas for improvement, and guide you through every step of the debt elimination process. They can help you discuss lower interest rates with creditors, explore debt consolidation options, or create a financial strategy that gets results.

- Don't take action today and arrange a consultation with a qualified professional.

- Keep in mind that you're not ask for help.

- Taking professional guidance can be the first step towards peace of mind.

Consolidate Your Debts: Simplify Payments, Reduce Interest Rates

Are you struggling to keep track of a bunch of distinct debts? Do high interest rates feel like they're holding you back? Debt consolidation could be the key you need. By combining your current balances into one new agreement, you can simplify your monthly payments and potentially lower your overall interest rate. This can increase cash flow, allowing you to focus on other objectives.

A debt consolidation plan can provide a easier path to becoming mortgage-free. It can also improve your credit score over time by making your payments more consistent. If you're feeling overwhelmed by your debts, consider exploring the benefits of consolidation.

- Explore different debt consolidation options to find the best fit for your needs.

- Check loan terms carefully to ensure you're getting a favorable deal.

- Track your spending to stay on top of your financial commitments.

Take Control in Your Finances: Expert Guidance on Debt Management

Feeling overwhelmed by debt? You're certainly not alone. Many individuals battle with financial burdens, but it's absolutely possible to take control and achieve financial stability. A solid plan is crucial for effectively managing debt and creating a brighter financial future. Start by evaluating your current situation, including all your liabilities. Create a budget that tracks your income and expenses, allowing you to identify areas where you can minimize spending.

- Explore debt consolidation options to simplify payments and potentially lower interest rates.

- Think about seeking guidance from a reputable credit consultant who can provide personalized advice and solutions.

- Remember, building healthy financial habits takes time and discipline. Stay determined on your goals and celebrate your achievements along the way.

Stop Stressing About Debt: Our Experts Negotiate for You

Are you swamped with debt collector calls? Do you feel anxious about mounting bills? It's time to break free from the cycle of debt. Our experienced team is here to advocate on your behalf, reducing your financial obligation. We work tirelessly with creditors to obtain favorable terms that fit your budget.

- Gain peace of mind knowing a expert professional is handling your debt situation.

- Prevent the harassment from relentless debt collectors.

- Rebuild your credit score and financial health.

Don't hesitate any longer. Contact us today for a free consultation and let us help you ultimately say goodbye to debt collectors.

A Fresh Start Awaits: Debt Relief Options for Every Situation

Are you feeling overwhelmed by debt? It's a common problem, and the good news is that there are numerous choices available to help you find relief. Whether your situation is due to unforeseen expenses, medical bills, or simply managing costs, there's a way forward.

A variety of initiatives can assist you in getting back on track. From debt counseling to negotiation, these resources can help you reduce your monthly payments. Remember, seeking help is a sign of strength, and taking the first step towards relief can be incredibly empowering.

It's essential to investigate different options and determine the one that best suits your needs. Don't hesitate to contact a qualified professional who can provide personalized guidance and support.

Reclaim Your Financial Stability : Achieve Financial Stability with Our Proven Programs

Are you facing challenges to control your finances? Do debt feel impossible? You're not alone. Many individuals and families go through financial difficulties. The good news is, you can restore control and establish a solid foundation for your future. Our comprehensive programs are designed to guide you every step of the way, providing the tools and resources you need to reach financial stability.

- Our programs offer:

- Debt management

- Investment guidance

Don't delaying. Take the first step towards a brighter financial future today!

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Katie Holmes Then & Now!

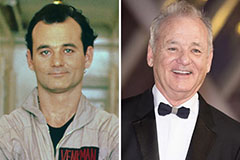

Katie Holmes Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!